J. de Demandolx Gestion and Financière Tiepolo join forces with the support of Andera Acto

Financière Tiepolo and J. de Demandolx Gestion are pleased to announce that they have joined forces to become one of the leading independent players in non-intermediated private banking in France.

The founding families of the two companies, the partners and the employees will own 100% of the combined entity, with the objective of generational transmission. The new company will have 32 employees and assets under management of around €1.8 billion for some 1,400 families. This transaction is supported by Andera Acto, an independent French private equity firm.

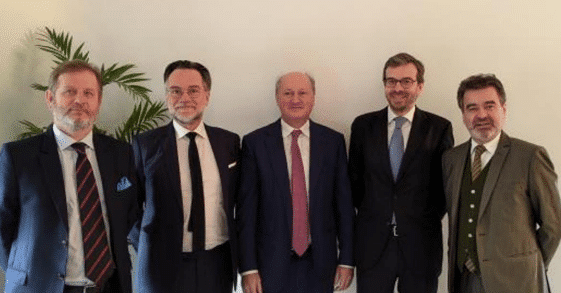

On the governance side, Roland de Demandolx will take the reins of the company as chairman. Alongside him, Philibert de Rambuteau and Nicolas-Xavier de Montaigut will act as co-CEOs. The historical partners Dominique Villeroy de Galhau – until now general manager – and Thierry Barbier, current general secretary, will join the new management committee and will keep a significant share of the capital. Eric Doutrebente will be the Chairman of the Supervisory Board.

PAX Corporate Finance acted as exclusive advisor to the managing shareholders J. de Demandolx Gestion in the context of the merger with La Financière Tiepolo as well as on the overall financing of the transaction. At the heart of this merger lies the interest of clients and the desire to maintain a high quality, tailor-made service. It allows the two companies, which share common values, to display strong development ambitions in the demanding business of portfolio management.

Eric Doutrebente, Chairman of Financière Tiepolo, said: "We are particularly pleased with this merger between two companies that have known and appreciated each other for many years. They have based their development on identical cultures, both in terms of client services and management typology. I am convinced that this new entity, with its strengthened expertise, will easily confirm its place among the leaders in independent private banking in France.

Roland de Demandolx, Chairman and CEO of J. de Demandolx Gestion confirms: "This transaction is very good news for our clients and our employees. Our shared values and entrepreneurial spirit will create a flagship asset management company, ready to meet our clients' expectations in terms of tailor-made services and efficient and responsible financial management".

Other references